Legal and economic experts agree that consumer legal funding greatly benefits individuals pursuing legal claims. This article summarizes why the benefits of Cartiga’s funding outweigh the costs and other concerns.

The Top Four Benefits of Consumer Legal Funding

The significant benefits of legal funding for claimants have been confirmed by numerous experts in well-researched papers cited below. Those benefits include:

- Funding provides money to claimants to pay living and medical expenses and to keep their lives intact while waiting for fair resolution of their legal claims;

- Funding levels the playing field between claimants and corporate defendants (who have superior resources and will use delay to create unfair outcomes);

- Funding allows claimants to lock in some of the value of their claims and transfer some of their risk of loss to Cartiga

- Without legal funding, cash-strapped claimants may resort to credit cards, payday lending, or pawnshops, which can create a devastating “debt spiral.”(i)

Studies Show That Funding Results in Higher Settlements

One study by two economists concludes that “optimal” consumer legal funding (i.e., funding that maximizes the expected payoff) induces better settlements than are achieved in cases without funding.(ii)

Another study by a Ph.D. in law and economics found that the availability of funding in Ohio medical malpractice cases increased payments to claimants by 28 to 46.7 percentage points! The data shows that funding allows a claimant to hold out for higher settlements because it decreases their risk (by shifting risk to the funder) and increases their ability to hold out for higher settlements (by advancing cash to pay their living expenses).(iii)

Insurance companies are also studying these issues and must be reaching these same conclusions. Their lobbying organization has proposed legislation across the country limiting or effectively barring consumer legal funding.(iv) Experts have noted that such legislation forcing funding companies to exit the market will be “considered a victory for the insurance industry.”(v)

The Concerns About Consumer Legal Funding

Critics of consumer legal funding do not dispute these well-documented benefits. Instead, they raise three main concerns:

- Consumers do not understand the terms of the funding they receive and may be unable to make rational decisions about litigation funding.

- Funders should use data analysis to inform consumers about expected payment dates and total payments.

- The cost of consumer legal funding is too steep because the risk of non-repayment is not high enough to justify the fees.(vi)

Cartiga’s Legal Funding Is Transparent and Carefully Managed

Any concerns with respect to the terms of Cartiga’s funding contracts are unfounded. Cartiga’s funding is fully transparent, and its contracts are written in plain and simple language so that consumers can fully understand all the costs and make rational decisions. New state regulations require this full transparency.(vii)

Cartiga also uses advanced data analytics to help lawyers and their clients understand and manage their expected costs of funding. This data measures the duration cost (how long the case takes to resolve), the inception cost (when, in the case, the funding is advanced), how much funding is advanced relative to the case value, and whether the funding is provided by more than one company. Managing these costs ensures optimal use of funding.

The Actual Cost of Cartiga’s Legal Funding is Fair

The only meaningful concern regarding consumer funding is the cost, which critics claim is too high relative to the risk. There are numerous reasons why the benefits for claimants far outweigh the cost of consumer legal funding:

First, as two legal experts have recognized, concern over the high cost of consumer legal funding is not grounded in reliable data. It is based on anecdote and speculation.(ix) Similarly, complaints that the cost of funding leaves claimants with inconsequential recoveries on their claims are unsupported by the data, and are frequently based on miscalculations of the true cost of funding.(x)

Second, whether the cost of funding is “too high” depends on each claimant’s circumstances. More than 60% of Americans live paycheck-to-paycheck. Economists say that when consumers lack cash to pay bills for living expenses and medical treatments, a higher-cost product can be economically rational because the benefit of funding today outweighs the cost of funding in the future.(xi)

Third, legal experts acknowledge that funding companies occasionally accept less than the amount owed under the funding contract even when the consumer has received sufficient money in the settlement to cover it.(xii) Some claimants effectively pay a lower cost than assumed.

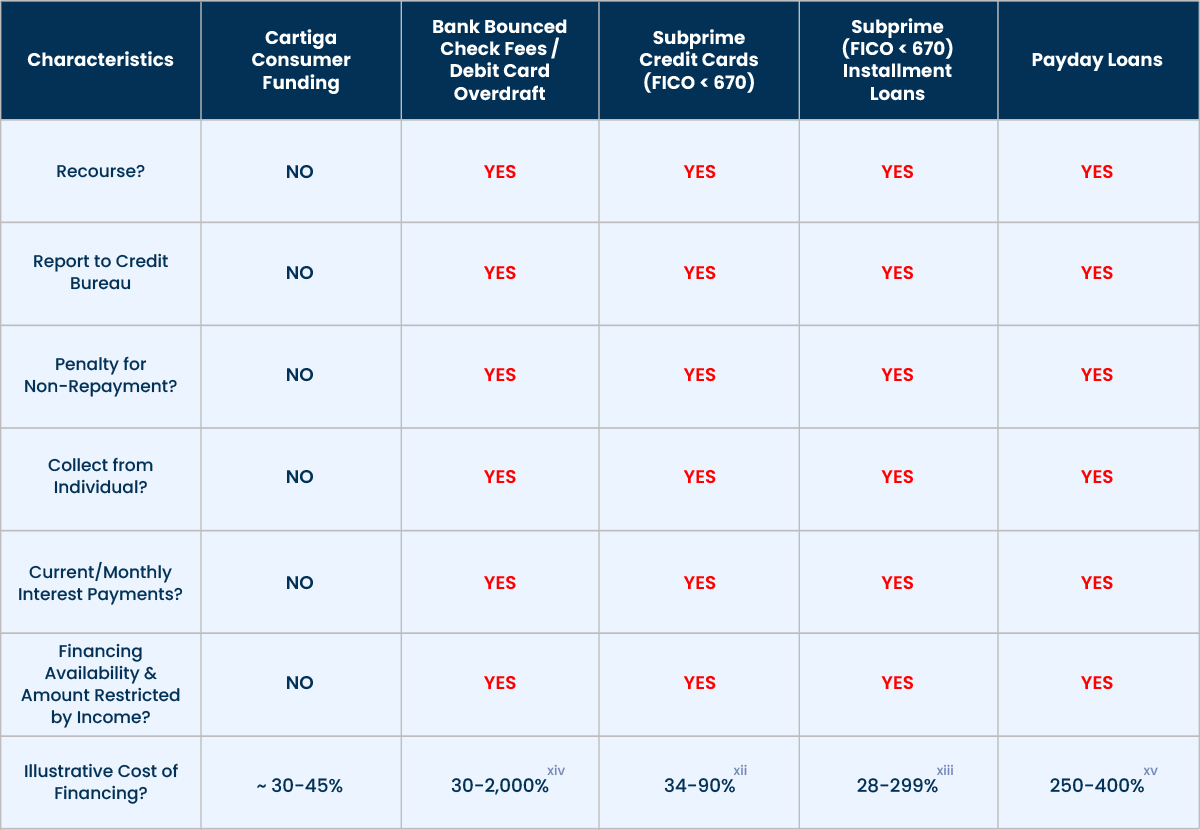

Finally, the all-in cost of non-recourse consumer legal funding is typically much lower than alternative sources of money available to unbanked or underbanked claimants who need to pay their bills. Claimants are often in lower income brackets with lower FICO scores and rarely have access to money at a comparable cost. For example, a typical subprime credit card can have an effective annual financing charge cost, when accounting for interest expense, annual fees and maintenance fees, of 70% or higher.(xiii) Similarly, unsecured consumer installment loans frequently carry interest costs ranging from the high double digits to as high as 299%.(xiv) Perhaps most onerous of all, the CFPB has noted that consumers utilizing overdraft services on a debit card can pay effective interest charges at rates well above 2,000% annualized.(xv)

Absolute cost is not the only factor to consider: non-recourse consumer legal funding has none of the many negative attributes of alternative sources of money. Unlike consumer funding, credit cards, unsecured installment loans, payday loans, and checking account overdrafts all require regular principal and interest repayments. Suppose those regular payments are not made in full. In that case, there is:

- An acceleration of the total amount due.

- Credit bureau reporting.

- Penalties for delinquent payments.

- Individual collection proceedings, including wage garnishment.

None of these alternatives is economically feasible or attractive for claimants who may need money for an extended period (two or three years) and can only make monthly payments once their legal claim is resolved.

Comparative Sources of Money for Claimants

Conclusion

There is substantial evidence, confirmed by legal and economic experts, that Cartiga’s consumer funding provides significant benefits to claimants who need money to pay living and medical expenses to keep their lives intact. Those benefits are enhanced by Cartiga’s transparency and data analytics. The benefits outweigh the costs and other alleged concerns regarding consumer legal funding, especially because Cartiga focuses on managing those costs for optimal results. The other available sources of money for claimants are more expensive and can have very negative credit consequences.

This article is for marketing purposes only, does not constitute legal advice, and should not be relied upon as legal advice.

(i)Heuristics, Biases, and Consumer Litigation Funding at the Bargaining Table, Vanderbilt Law Review, Vol. 68:1:261, 266 (2015); Ronen Avraham and Anthony Sebok, An Empirical Investigation of Third-Party Consumer Litigant Funding, 104 Cornell L. Rev. 1133 (2019); Paige Marta Skiba and Jean Xiao, Consumer Litigation Funding: Just Another Form of PayDay Lending? Law and Contemporary Problems, Vol. 80:117, 119, 121-123, 126, 137-138, No. 3 (2017); Andrew F. Daughety and Jennifer F. Reinganum, The Effect of Third-Party Funding of Plaintiffs on Settlement, American Economic Review, Vol. 104, No. 8, pp. 5-6 (August 2014); Susan Lorde Martin, Litigation Financing: Another Subprime Industry That Has A Place In The United States Market, 53 Vill. L. Rev. 83, 84-85, 100, 101-102 (2008); GAO Report on Third-Party Litigation Funding: Market Characteristics, Data, and Trends, pp.12-14, 18-19 (December 2022).

(ii)Andrew F. Daughety and Jennifer F. Reinganum, The Effect of Third-Party Funding of Plaintiffs on Settlement, American Economic Review, Vol. 104, No. 8, pp. 1, 2, 6, 21 (August 2014).

(iii)Jean Xiao, Consumer Litigation Funding and Medical Malpractice Litigation: Examining the Effect of Rancman v. Interim Settlement Funding Corporation, Law and Economics PhD Program, Vanderbilt University, pp. 1, 5, 8, 12-13, 25 (June 2017).

(iv)See, e.g., https://www.insurancejournal.com/news/national/2022/03/03/656613.htm

(v)Michael A. Wittman, Finding Transparency & Equity in Consumer Litigation Funding, University of Pennsylvania Carey Law School: Legal Scholarship Repository, p. 5 (2022)

(vi)Heuristics, Biases, and Consumer Litigation Funding at the Bargaining Table, Vanderbilt Law Review, Vol. 68:1:261, 267-268 (2015); Consumer Litigation Funding: Just Another Form of PayDay Lending? Law and Contemporary Problems, Paige Marta Skiba and Jean Xiao, Vol. 80:117, 119-120, 128-129, 136 No. 3 (2017); Michael A. Wittman, Finding Transparency & Equity in Consumer Litigation Funding, University of Pennsylvania Carey Law School: Legal Scholarship Repository, pp. 2, 9 (2022); GAO Report on Third-Party Litigation Funding: Market Characteristics, Data, and Trends, pp. 20-21 (December 2022).

(vii)Ronen Avraham and Anthony Sebok, An Empirical Investigation of Third-Party Consumer Litigant Funding, 104 Cornell L. Rev. 1133, 1139 (2019).

(ix)Ronen Avraham and Anthony Sebok, An Empirical Investigation of Third-Party Consumer Litigant Funding, 104 Cornell L. Rev. 1133, 1137 (2019);

(x)Ronen Avraham and Anthony Sebok, An Empirical Investigation of Third-Party Consumer Litigant Funding, 104 Cornell L. Rev. 1133, 1141-42 (2019).

(xi)Consumer Litigation Funding: Just Another Form of PayDay Lending? Law and Contemporary Problems, Paige Marta Skiba and Jean Xiao, Vol. 80:117, 127 No. 3 (2017); https://www.cnbc.com/2023/07/31/61percent-of-americans-live-paycheck-to-paycheck-even-as-inflation-cools.html.

(xii)Michael A. Wittman, Finding Transparency & Equity in Consumer Litigation Funding, University of Pennsylvania Carey Law School: Legal Scholarship Repository, pp. 12-13 (2022); Ronen Avraham and Anthony Sebok, An Empirical Investigation of Third-Party Consumer Litigant Funding, 104 Cornell L. Rev. 1133, 1143 (2019).

(xiii)Based on disclosed APR and other charges for subprime card issuer Continental Finance assuming utilization of a $500 credit limit as shown: (https://continentalfinance.net/Content/PDF/GetTermsAndConditionsCELTIC.pdf

(xiv)Loan rates based on disclosed rates on installment loans from Elevate Credit & Curo Financial ( see: https://www.bankrate.com/loans/personal-loans/reviews/rise-elevate/#at-a-glance,

https://www.consumerfinance.gov/ask-cfpb/what-are-the-costs-and-fees-for-a-payday-loan-en-1589/; see also Susan Lorde Martin, Litigation Financing: Another Subprime Industry That Has A Place In The United States Market, 53 Vill. L. Rev. 83, 98-101, 105 (2008)