At Cartiga, we want our consumer legal funding to be fully transparent. Law firms and their clients should fully understand how funding can affect the client’s recovery in any settlement and how to calculate Cartiga’s real share of any settlement.

The proper calculation of Cartiga’s share of any settlement recovery is sometimes misunderstood. We occasionally hear the adage that “the client receives a third of the settlement, the attorney receives a third, and the funding company receives a third.” That should very rarely be the case. The simple explanation of Cartiga’s real share of any settlement is as follows.

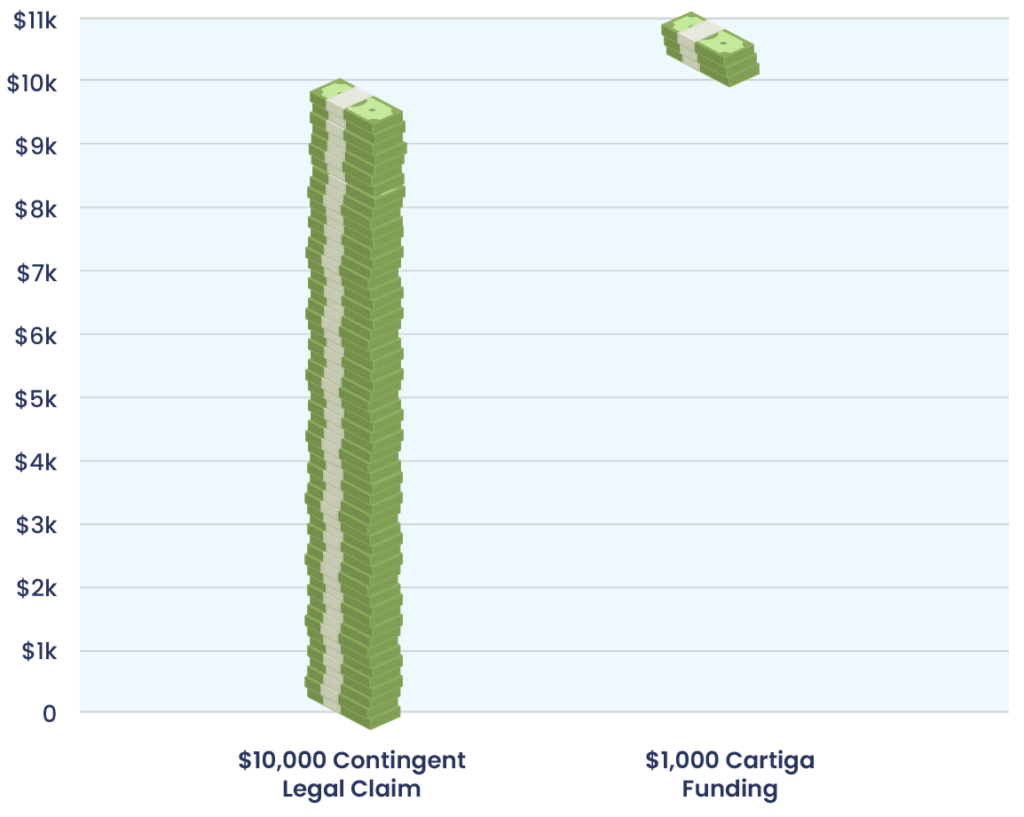

Cartiga’s consumer funding provides the client with money in addition to the value of their legal claim case. For example, if a client has a legal claim with an expected settlement value of $10,000, Cartiga will increase that value by providing the client with funding of $1000.

As a result, the client has immediately pocketed a 10% tax-free return on the legal claim while still retaining the right to recover the full $10,000 amount of that claim. After funding, the client has two assets: the contingent legal claim worth $10,000 plus cash of $1,000.

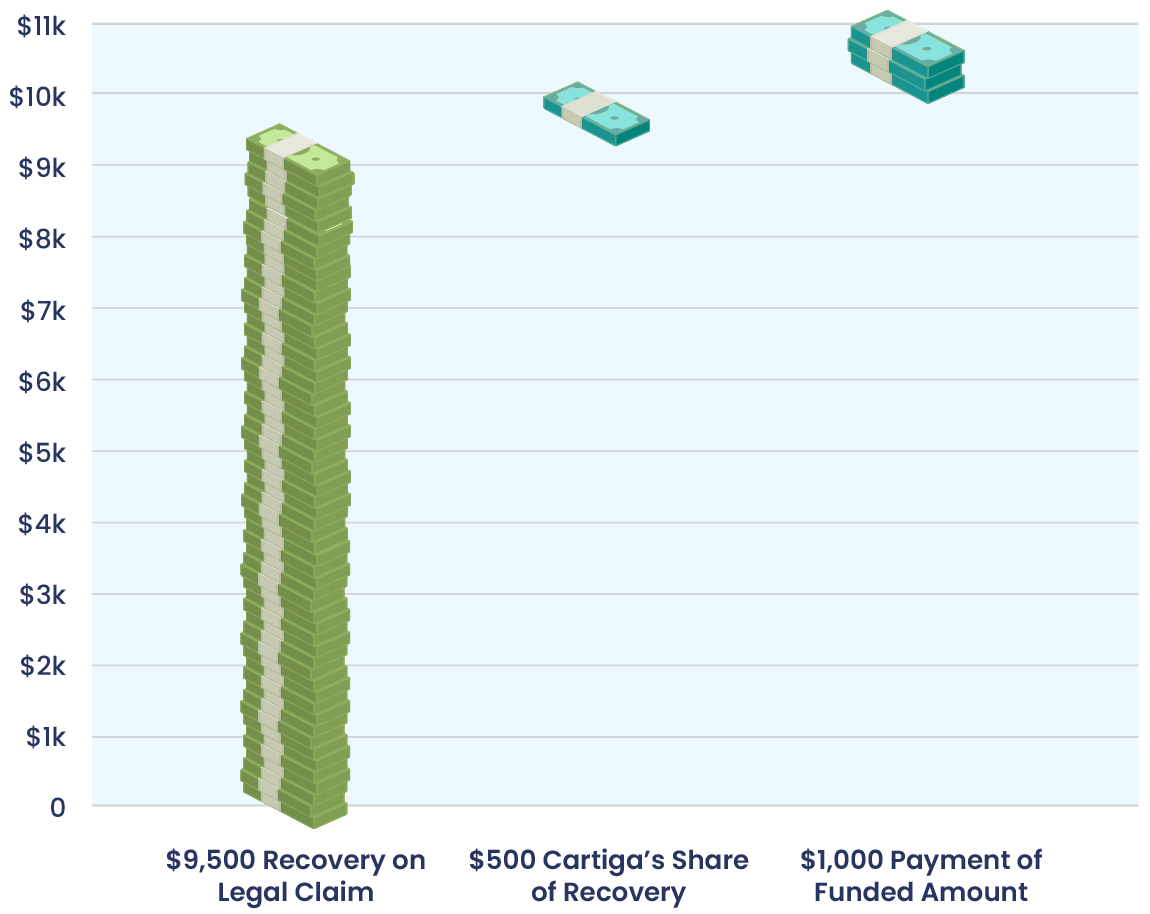

Where a misunderstanding sometimes arises is at the end of the case. If the client recovers the full $10,000 value of the case in a settlement, the client must then pay for the funded amount received from Cartiga, plus accrued fees on that funding. Assuming that the case lasted more than a year and a half, and the fees for the funding accrued as a result to $500, the client will owe $1,500 to Cartiga (the $1,000 funded amount plus the $500 in accrued fees). The client will sometimes mistakenly conclude that because $1,500 is owed, Cartiga’s share of the settlement recovery is 15% and that the client’s return from the settlement is accordingly reduced by 15%. That is incorrect.

In fact, Cartiga’s real share of the settlement recovery in this example is much less. Cartiga’s share is only 5%, which is the amount of the $500 in accrued fees. The client’s return of the $1,000 funded amount does not diminish the client’s share of the settlement recovery; it is simply a payment of cash equal to the $1,000 funded amount the client received from Cartiga (which funded amount the client has had the benefit of using during the pendency of the litigation).

In short, a client’s return on a legal claim should be calculated based on the fees accrued on Cartiga’s funding, not on the funded amount plus the fees. Understanding this proper calculation of Cartiga’s real share, provides an accurate picture of how funding can affect the client’s recovery in any settlement.

This article is for marketing purposes only, does not constitute legal advice, and should not be relied upon as legal advice.